A set of progressive initiatives is currently under consideration in California, with potential implications beyond state borders. One noteworthy proposal being discussed in Sacramento involves the introduction of a wealth tax targeting high earners, accompanied by a unique enforcement approach involving plaintiff attorneys as bounty hunters to pursue alleged tax evaders.

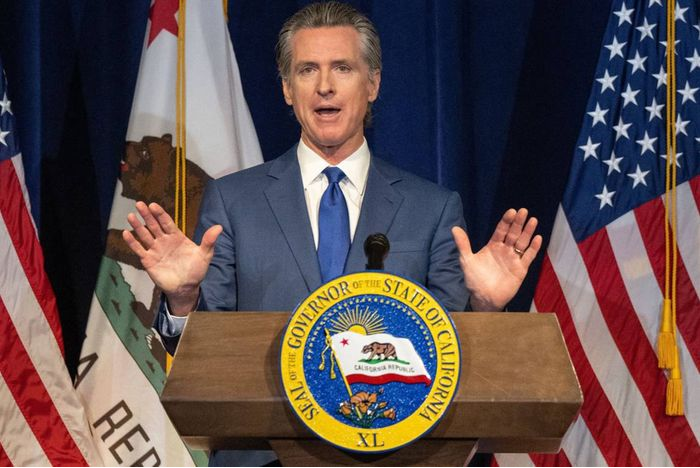

The bill, initially introduced by Democrats last winter, is set to undergo a hearing in the state Assembly this Wednesday. The timing is significant, given the urgent need to address a projected $68 billion budget deficit. Governor Gavin Newsom is also slated to unveil his budget for the upcoming year on the same day, with Democratic lawmakers presenting the wealth tax as an alternative to austerity measures.

Under the proposed legislation, a 1.5% annual excise tax would be imposed on the worldwide net worth of California residents—both full- and part-year residents—exceeding $1 billion, starting from the current tax year. From January 1, 2026, wealth exceeding $50 million would face a 1% annual tax, along with an additional 0.5% on assets surpassing $1 billion.

Part-time residents would be subject to a pro-rata share of the tax based on their annual days spent in California, and the tax would also apply to recent nonresident departures from the state. The broad scope of the wealth tax encompasses various assets, including partnership shares, private equity interests, artwork, and offshore financial holdings. Notably, real property has been exempted, possibly to accommodate high-end real estate and Hollywood donors.

The bill introduces an intriguing twist by applying the state’s False Claims Act to wealth-tax records and statements, allowing plaintiff attorneys to leverage the law against affluent individuals accused of underreporting assets. This novel approach ties the financial incentives of plaintiff attorneys to the state’s recovery, potentially fostering a new avenue for legal action.

Proponents estimate that the wealth tax could generate $21.6 billion in annual revenue, assuming no mass exodus of wealth from the state. However, this falls significantly short of covering the current fiscal year’s $68 billion budget deficit and the $27 billion increase in Medicaid spending over the last four years, especially with ongoing expansions in Medicaid eligibility.

Simultaneously, California is witnessing an increase in the top effective marginal tax rate on wage income, reaching 14.4% this year due to the removal of the $145,600 wage ceiling on a 1.1% state employee payroll tax. This adjustment, aimed at funding expanded paid family leave, raises concerns about its potential impact on businesses and high earners.

In essence, the proposed wealth-tax bill underscores Sacramento’s persistent inclination toward introducing new taxes to support growing expenditures. This tax-and-spend dynamic raises questions about the sustainability of California’s financial model, as even the state’s affluent may find it challenging to meet escalating welfare and government-worker obligations. It remains to be seen if, in the pursuit of revenue, Democrats may eventually turn their attention once again to the middle class.x